Future-Ready Fintech App Development: Complete Guide for Your Startup

Finance + technology= is a fascinating, dynamic sector in 2021 that everyone is talking about. The continued use of digital payments, as well as the rising demand from financial institutions to integrate cutting-edge technology, has significantly altered the once-traditional financial environment.

As you may have seen, fintech is currently one of the trendiest sectors. Even a disaster like the current worldwide epidemic couldn't destabilize the business. Instead, the fintech sector only experienced a rise during these trying times. If you want to invest in fintech or create a fintech firm, now is the moment, and it all begins with fintech app development.

This post summarises the winners in important areas, including app store optimization, user retention, and key features based on the in-depth study.

What is Fintech?

Fintech apps have been increasingly popular in recent years, with startups, banks, and financial institutions trying to expand their operations and generate funds. Popularity and profitability are driving organizations to seek assistance on how to construct a Fintech App. These Fintech solutions benefit both businesses and customers since they allow them to conveniently and rapidly access financial services at any time via the use of technology.

Fintech applications may be built with a variety of technologies, including machine learning, artificial intelligence, and blockchain. These digital solutions, designed with cutting-edge technology, assist to expedite and optimize financial service delivery. Over time, the Fintech sector has successfully offered its consumers safe, convenient, and scalable financial services via mobile devices. As a result, firms who are new to the industry or want to engage in it are under pressure to come up with something distinctive in order to attract customers' attention.

The Fintech Industry is Being Reshaped by AI and Machine Learning

Given below you can check out the latest domains which will make your app reap the game.

The Most Appropriate Domains for your Fintech App Development

Banking

Most banks currently prefer mobile banking applications to deliver increased services to their consumers, but only a handful of them match users' expectations. Many customers make use of these services because they like the convenience of banking. Banking applications enable users to transfer and manage money without having to visit a bank.

Mobile banking startups also bring several benefits to banks, such as a wide range of banking services supplied to clients to make banks more competitive, as well as the inclusion of additional services to enhance income.

Apps for Personal Finance

These applications assist users in managing their money and planning their monthly or yearly budgets by saving or keeping track of their costs. Payment processing services are often not included in personal finance applications.

When it comes to entry-level apps with a restricted budget, these apps are less sophisticated. Finch, Mint, and StockApp are among the most well-known personal financial applications (applications we worked on).

Apps for Cryptocurrency

Another form of an app to be aware of when researching how to design a Fintech app is a cryptocurrency application. People may use these apps to buy, store, and trade cryptocurrency. The popularity of such financial applications is rising by the day, therefore we urge that you investigate this alternative more. Coinbase and Binance are two of the most well-known cryptocurrency programs.

Apps for Trading and Investing

Investment apps are a great way to get started in the stock market. By offering appropriate insights and data, investment management systems help users to enhance the performance of their assets. Check out Addepar if you want to build a digital investing app.

Check ExpertAppDevs Portfolio: Finest Trading App - A Premium Investment for Your Future

Apps for Insurance

The goal of such apps is to expedite policy management and insurance processing. People may rapidly obtain insurance in any location by using an insurance application. Take a peek at the BIMA app if you're thinking about developing mobile apps for Fintech in the insurance industry.

BIMA is a supplier of mobile insurance. The software collaborates with cell carriers and financial institutions to provide insurance and underwriting to millions of low-income consumers. BIMA offers microinsurance alternatives for life, accident, and health.

Let’s delve a little deeper and understand how to build a future-ready fintech app that will help you conquer the above-mentioned domains?

How do you create a Fintech app that will be used by thousands of people? Our team has created a comprehensive guide in which we will explain each stage of Fintech app development.

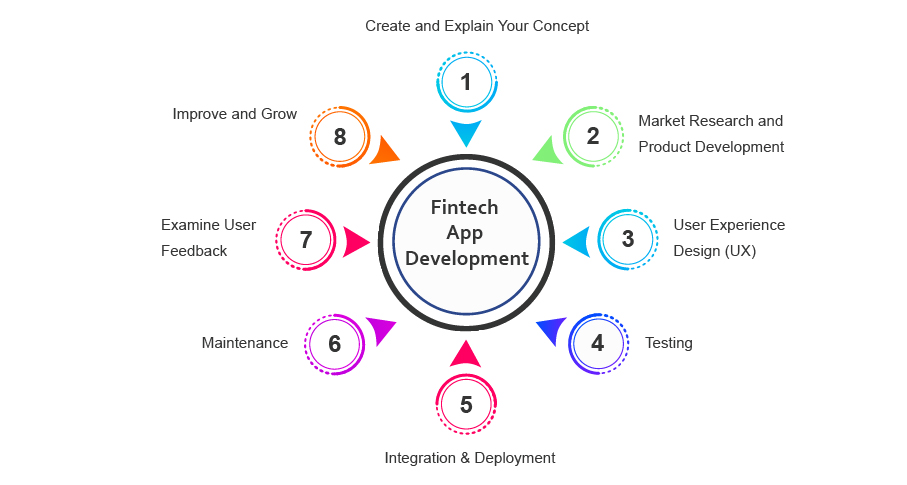

The Fintech Application Development Process

Point 1: Create and Explain Your Concept

First, you should develop and sketch the concept for your potential product. Describe each and every detail. It's critical. This is the initial stage of your growth plan. And the plan is required to keep the project's work organized and structured.

Furthermore, a detailed explanation of your proposal will help your prospective colleagues understand what you hope to gain as a result.

Point 2: Market Research and Product Development

Work on product development begins immediately from this point forward. In general, this stage consists of the following:

Agile Methodology for Market Research Technology Adaptation

You should research the market and the current Fintech apps. To improve your product, we propose that you carefully evaluate the strengths and flaws of existing Fintech apps.

Product discovery can assist you in determining whether or not it is worthwhile to create a new product and whether or not people will utilize it. The following are the major steps in product discovery:

- Improve your capacity to empathize with consumers by being acquainted with their underlying needs and emotions.

- To acquire a complete image of your consumer, crowdsource your team's varied points of view.

- Take note of what your customer says. Instead of jumping to a solution, consider the cause of the customer's problem.

- Visual mapping might help you acquire clarity.

- Collect consumer feedback via various channels of contact (e.g., social media, email, customer service, user research, customer advisory board, etc.).

- Keep your objectivity. Are the offered solutions compatible with the challenges, or are you biassed? Keep in mind that not every idea will be implemented.

- Check your assumptions.

Point 3: User Experience Design (UX): Prototyping, Product Logic, and Navigation

Then you may begin working on a UX design. If you don't have a good UX design process, you have a lower chance of producing a good UX product. A well-defined and well-executed UX process, on the other hand, enables the production of incredible user experiences.

If we apply design thinking to product design, we will go through a UX process that involves the following five steps:

1. Design Thinking for Your Product

- Product description

- Interviews with stakeholders

- Mapping of Value Propositions

2. Designing a concept

- Conduct research

3. In-depth interviews with individuals

- Analysis of competitive research

- Developing user personas

- Developing user stories

4. Storyboarding

- Making wireframes

- Making prototypes

- Designing a Specification

- Developing design systems

5. Verification

- Sessions of testing

- Surveys - Analytics

Point 4: testing

You will need to test the UX design after it is completed. At this point, you should know whether you constructed the product logic correctly, whether consumers understand where everything is in the product, whether everything suits them, and so on.

After obtaining the test results, you will know whether or if you need to make changes to the UX design.

Point 5: Integration & Deployment

Following the development and regression testing by the QA team, the team goes on to production deployment and integration. The tested version of the product is released to beta testers. The team gathers user feedback, handles any concerns, and makes some improvements.

Point 6: Maintenance

A team maintains a product after it has been deployed in the production environment. That is if an issue emerges that must be fixed, or if improvements must be made, the development team will take care of it.

Point 7: Examine user feedback

Collect customer feedback on your Fintech application next. Answer the following questions by taking a survey:

- Is it practical to utilize a Fintech app?

- Do people have any issues when using the product?

- How well does a Fintech app meet the demands of its users?

- What aspects of the product would people wish to see improved?

- How well does the product suit the needs of the users?

- You will know what you need to do if you get responses to these questions.

Point 8: Improve and grow

The product's development does not end there. After studying consumer feedback on your product, you should continue to enhance and develop it. The most important thing to remember is that growth is the key to success!

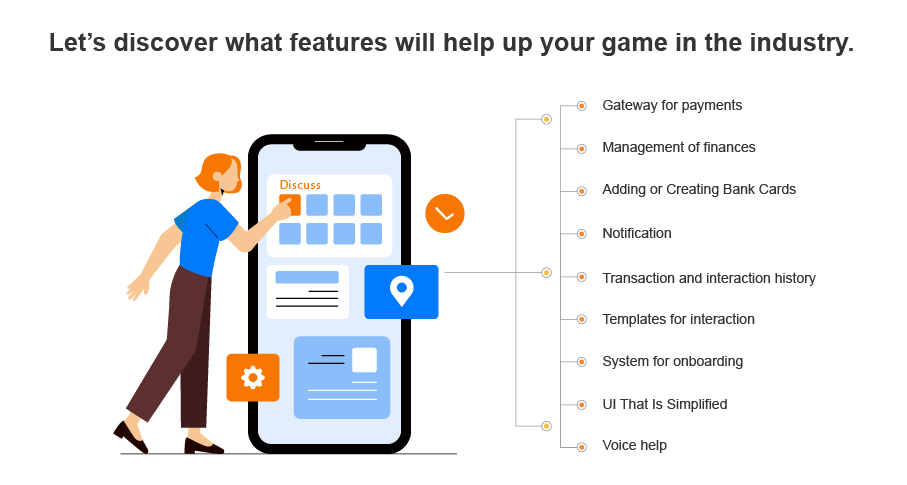

Must have Features of Fintech Application Development

- Gateway for payments: Makes sure your Fintech app has the capacity to accept payments. It makes no difference if you are developing a traditional banking application or a cryptocurrency application. Everywhere a payment gateway is required.

- Management of finances: Allows your users to manage their funds. Payment planning, financial management within a certain plan, spending budgeting, setting limitations for online payments, and so forth. People may manage their money and get the most out of the software this way.

- Adding or Creating Bank Cards: should be able to be connected by any Fintech application. After all, without it, the program is rendered nearly worthless. You may also integrate the card generation feature straight to the program if, for example, you are creating an application for a mobile device.

- Notification Add a notification mechanism so that users are always informed of what is going on in their application. As a result, consumers will always be alerted if they have moved money to a card or if the bitcoin rate has doubled.

- Transaction and interaction history: Add a transaction and interaction history to your app so that users can control the movement of their money and easily discover the person with whom they have recently dealt financially.

- Templates for interaction: Add interaction templates to your Fintech application for ease and time savings. These might be utility payment templates or monthly mortgage payment templates, for example.

- System for onboarding: Onboarding is required so that the user who accesses your program for the first time rapidly learns how to utilize it. You can utilize simple onboarding (for example, a few instructions and pictures on how to use the program) or complex ways (for example, use a highlight so that users know where and when they need to click).

- UI That Is Simplified: We began the article by stating how finance has always been complicated. And, as a fintech service provider, one of the first jobs at hand is to eliminate any type of difficulty associated with using fintech services. Foreign exchanges, investments, and point-of-sale systems are all complex, but you should simplify things for your users as part of your smooth fintech application development process. Orient your consumers to the world of fintech by providing an intuitive user experience, navigation, educational information, and more. This will pave the path for long-term retention.

- Voice help: One of the most rapidly implemented technologies in the digital world, provides maximum convenience to customers who have a smart virtual assistant installed in their homes. Contrary to common assumptions, many individuals are experimenting with virtual assistants for the amazement and experience they provide, which is why your app should enable voice-based searches, functions, and results retrieval methods.

Check out these must-have advanced features

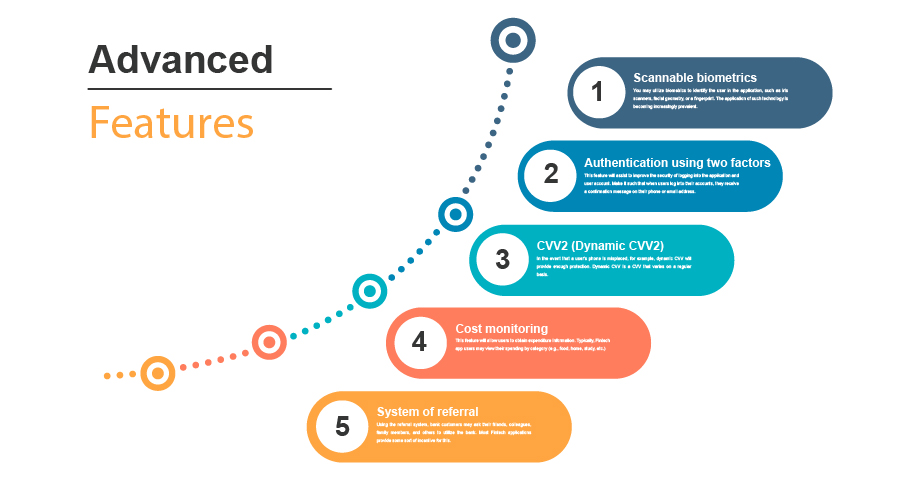

Scannable biometrics:

You may utilize biometrics to identify the user in the application, such as iris scanners, facial geometry, or a fingerprint. The application of such technology is becoming increasingly prevalent.

Authentication using two factors:

This feature will assist to improve the security of logging into the application and user account. Make it such that when users log into their accounts, they receive a confirmation message on their phone or email address.

CVV2 (Dynamic CVV2):

In the event that a user's phone is misplaced, for example, dynamic CVV will provide enough protection. Dynamic CVV is a CVV that varies on a regular basis.

Cost monitoring:

his feature will allow users to obtain expenditure information. Typically, Fintech app users may view their spending by category (e.g., food, home, study, etc.)

System of referral:

Using the referral system, bank customers may ask their friends, colleagues, family members, and others to utilize the bank. Most Fintech applications provide some sort of incentive for this.

Conclusion

So, these are the crucial characteristics of your fintech app that you should not miss. Fintech software application development services, as you can see, are pretty sophisticated. The more user-friendly it must look, the more difficulties must be recognized and overcome.

To assist you in launching an ideal app that people can rely on in the market, you should have your app built by a leading fintech app development company like Expert App Devs which has been in this industry for a long time. Only veterans and specialists in a financial software development business can assure your app's security, functionality, and scalability. That is why we encourage contacting us about your app idea.

Call us at +91 701 616 6822 or send us an email at [email protected] to get started on your financial app development project.

Jignen Pandya

Jignen Pandya