Open Banking API: A Fintech Game-Changer

The finest blend between the financial industry and technology has recently witnessed a giant leap. Commonly referred to as FinTech, the industry is growing rapidly, thanks to customer-focused fintech products and services.

Do you know that about 90% of Americans use FinTech services? Financial companies turn to technology to offer best-in-class services to their clients. The recent Covid-19 pandemic and global lockdowns have forced banking and financial companies to develop more customer-focused products and services.

In addition to that, the behavioral patterns of people are changing. The FinTech industry is developing new initiatives like an open banking API to meet their expectations and demands.

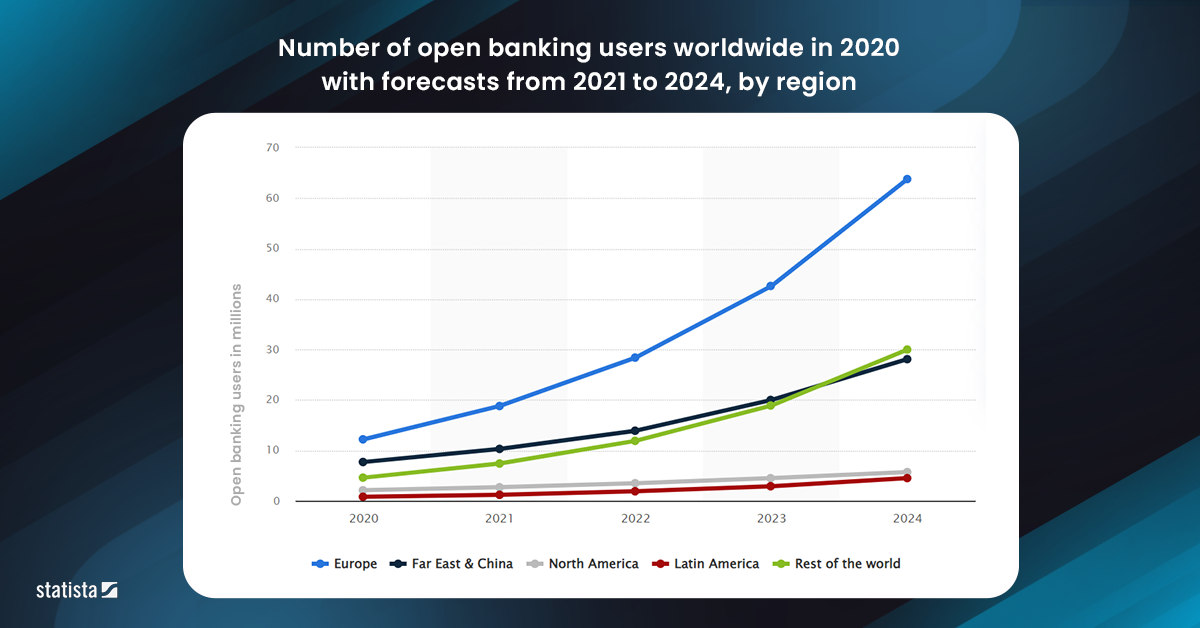

Statista predicts that 638 million people will use Open Banking in 2024. However, this new initiative is still in its childhood. As per Mckinsey, only 10% of open banking’s promise is realized as of now. However, this new trend is highly promising and will surely transform FinTech.

What are Open Banking and Open Banking APIs?

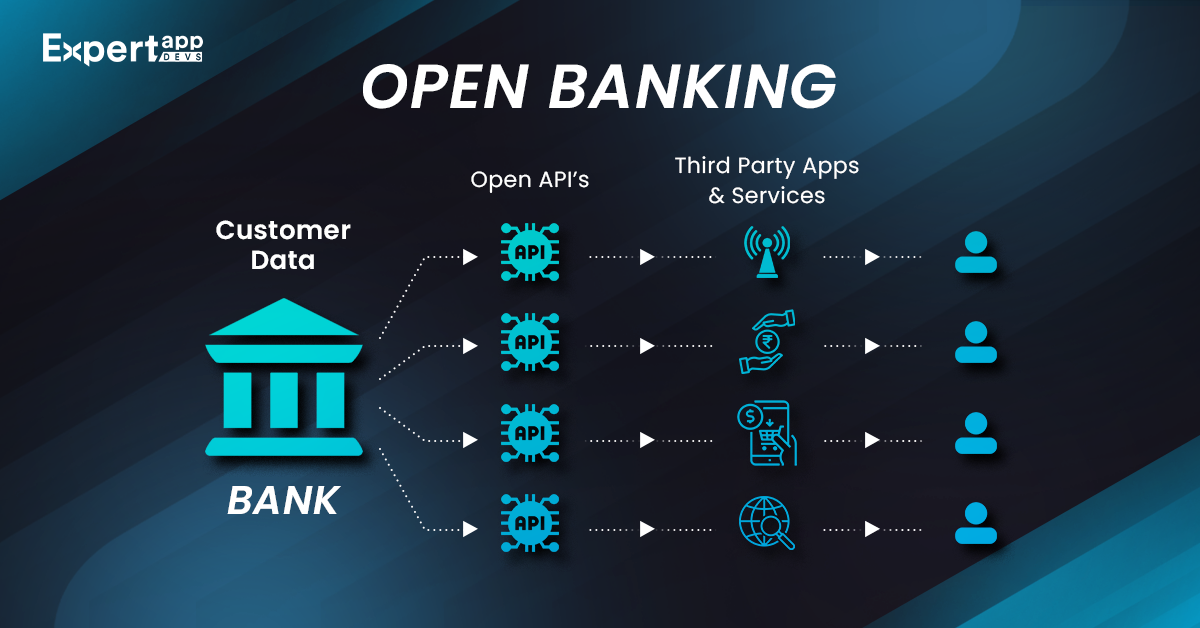

Open Banking is a financial concept that allows financial information exchange between two parties. For example, you have an account in a bank.

Open banking enables the bank to safely share its financial information or data with non-traditional financial institutions. Here, the bank shares the information via APIs, also called open banking APIs.

Non-banking financial institutions such as expense tracking companies, money lending companies, financial planning companies, and others use open banking prospects.

Such safe financial data exchange allows FinTech companies to offer highly-personalized and client-centric financial services.

Banks and other financial players collaborate to develop highly convenient and client-centric solutions. the main aim is to meet customers' expectations to ease banking and payment-related operations.

This surge has led to the popularity of Open Banking APIs. Banks and other financial players use open banking APIs to grow their customer base. On the other hand, third-party financial institutions use APIs to offer highly personalized offerings and products.

What is an API?

Generally, an API, Application Programming Interface, allows communication between two devices. In FinTech terms, APIs allow developers to communicate with a service provider like a bank. However, it is more challenging than it seems. First, the service provider will publish a list of API specifications to which the bank must adhere.

people call it Open API, as any third-party developer can access it under some specific conditions. Open APIs have specifications available to the public, but the stakeholders might limit the available data as per the agreement.

When a company opens an API, other third-party stakeholders can consume the API to provide those services over the Internet.

Benefits of Open Banking APIs

An open banking API can offer great value to both consumers and bankers.

1. Data Insights

Banks can get valuable customer data insights, such as buying history, past investment records, financial goals, and other crucial financial information. Banks can use this information to fine-tune their financial products or services to offer highly customized services to customers.

2. Improving Services Rapidly

Open banking APIs also help banks and financial institutions improve service quality by considering customer feedback and reviews.

3. Rapid Product Development

Open banking APIs can become instrumental to banks and other institutions to develop precious and customer-centric products rapidly. Some services are risk management, loan processing, voice or chat banking, etc.

4. Serve Tech-Savvy Customers

Millennials are tech-savvy and mostly use non-traditional services from banks. You can target those customers by offering them highly valuable financial assistance and earning them loyalty.

5. Increased Innovation

FinTech companies use an open banking API to get financial data from banks. With such data, they can improve their services and accelerate innovation by developing customer-centric products and services. Not just that, they can also enhance and streamline their financial processes with the help of technology.

6. A New Revenue Stream

Another benefit of open banking APIs is that it generates a new revenue stream for banks. Banks can easily monetize open banking APIs. Banks have a large customer base, and financial players have technology, innovation, and speed.

Together, they can use valuable data insights effectively to generate shared revenue.

Rise of Open Banking API

There are three primary reasons behind the rise of open banking APIs. We will discuss them in detail here.

1. Rising Customer Expectations

A survey by PwC revealed that 15% of customers want to access banking services through their smartphones.

Customers' buying and behavioral patterns are changing rapidly, especially in the financial sector.

Customers don't want to visit a nearby bank to avail of banking services. They are tech-savvy who love to use advanced features for transactions. If you can offer personalized services, they most probably, share also share their data.

Millennials don't just want banking services; they want a sense of gratitude while dealing with businesses. They want a wholesome experience that offers them a feeling of gratitude.

2. Competitions from FinTech

FinTech companies have the best weapon to compete with banks- Technology.

They use technologies to improve their financial services and offer customers a seamless experience.

FinTech companies are partners of banks and not competitors. They can collaborate to provide their customers with highly streamlined, automated, and top-notch financial services.

Take the example of corporate payments. Banks have modern tools for bulk payments, but still they feel short of meeting the demands. On the other hand, FinTech companies have high-end payout services such as Cashfree. It is a FinTech app that offers fast, accurate, and automated bulk payment services.

Banks want to modernize their services to compete with FinTech service providers. It explains much about the rise of Open Banking APIs.

3. Rising Regulatory Environment

Different countries have different financial regulations. Meeting these demands and regulations might challenge banks and financial institutions.

Countries like the United Kingdom and China are open to competition and innovation. They want to open up data exchange between banks and third-party financial institutions. This initiative led to the rise of open banking APIs in the FinTech industry.

Key Challenges and Risks for Open Banking APIs

Though an open API banking concept offers many benefits, banks must address some challenges. We will discuss these challenges at length here.

1. Data Security

When fully embracing an open banking API concept, you must also consider the data security and financial privacy risks it brings.

You will need robust data privacy and data security regulations to mitigate such security and privacy risks.

Though various data privacy and security bills exist, you need robust data security measures while going for FinTech app development.

Open banking APIs might bring data security breaches, terrorist financing, and data theft challenges. You need strong regulatory plans to deal with such risks.

2. Customer Rights

You also need to ensure that adopting the open banking API concept does not hamper the rights of your customers. You will need a powerful grievance redressal system to protect customer rights.

Also, you need a consent-based data exchange system. iI allows customers to accept or reject data exchange requests from banks or FinTech companies.

Protecting the rights of your customers should be your primary responsibility. You need to take the proper steps to ensure it.

3. Compliance Risks

Banks can implement open API banking concepts while compiling with local or international privacy laws.

Compliance risks might be due to various reasons, such as penalties for poor decisive actions. sometimes, it can be an action/inaction of third-party FinTech companies or financial institutions.

You need to consider this challenge while embracing the open banking API concept.

4. Cyber Security Risks

Every day, we come to know about various cyber security breaches. Cyber criminals have become more advanced in their approaches. Data sharing between two parties might increase the risk of cyber security breaches and theft.

Banks or financial institutions must compensate customers in case of data theft during the exchange. Also, we must pay attention to other risks, such as misusing data, forgery, and malware. developers should address these issues to protect data privacy.

Types of APIs in Banking

There are a total of three types of APIs.

1. Private or Internal APIs

Banks use private or internal APIs, as the name suggests, to exchange information within the organization. Banks mostly use these APIs to improve their internal operations and streamline banking processes. Such APIs also reduce overhead costs, improve efficiency and productivity, and enhance security. Banks develop these open banking APIs for their operations.

2. Partner APIs

Banks develop partner APIs to share financial data with their regular partners for better integration and collaboration. They make a bilateral deal with the partner to use their systems for data exchange.

Remember that a partner API allows banks to disclose financial data with only one strategic partner. The main aim of developing a partner API is to reduce partner costs and monetize the API.

3. Open or Public APIs

Here, banks open an ecosystem for data exchange. Banks collaborate with third-party solution providers to develop highly advanced, innovative, and automated banking solutions.

Open banking APIs accelerate business growth and help banks in the bifurcation of financial products and services to a great extent.

However, different countries have different definitions of open banking APIs. For example, some banking experts believe that there should be a set of standardized APIs that all financial players can use. They believe in developing a shared ecosystem where almost all parties in the community can use APIs.

However, it is more challenging than it seems. To realize this, banks would require to publish API in a standardized way.

How Open Banking API Works

The working system of an Open Banking API follows this:

First, traditional banks will allow limited secure access to third-party FinTech players. So, FinTech players will get secured access to the bank's core system for data sharing.

They can now carry out various banking functions and access customers' data. They offer dedicated banking services to customers, such as online transactions, fund transfers, checking account balances, applying for loans or credit cards.

Let's understand this by an example:

- First, XYZ Bank allows access to ABC, a core FinTech company.

- Now, ABC company has access to XYZ's core banking system and integrates with the bank's API.

- Now, XYZ has started generating requests to the bank's server to execute various banking functions to fetch information.

- Now, businesses can use this API to access various banking APIs.

Successful Implementations of Open Banking API in FinTech

There are various open banking APIs exist already in the FinTech ecosystem. We will discuss two of them for further understanding.

1. Barclays APIs

Barclays does not need any introduction. It is one of the oldest banks in the UK, with more than 4,750 branches across the globe. The bank offers various services, such as retail banking, wealth management, investment banking, corporate banking, etc.

Barclays gives developers a wide range of APIs to integrate with other companies.

Functionalities of Barclays APIs

Barclays APIs offer a wide range of functionalities to FinTech partners, such as

- Login and Signup management

- Payment initiations

- Account and fund transfer information

- Customer card information saving

- Product detail sourcing

- ATM checking

- Branch location finding

2. Citi APIs

Citi Bank is a consumer branch of Citigroup and has 2,700+ branches worldwide. They offer various banking solutions and services, such as personal, business, mortgage, and commercial loans. Citi APIs are highly popular among FinTech companies like Qantas, MoneySmart, etc. They also offer different APIs for different regions.

Functionalities of Citi APIs

- Retrieving customer account information

- Approval of features

- Money Transfer

- ATM PIN reset

- Payments for CITI customer reward points

- Offering access to valid value sets and validations in different countries.

Conclusion: What is the future of Open Banking APIs?

The collaboration between banks and FinTech partners might benefit the entire financial industry.

Legacy banks get a chance to open up various revenue streams by embracing open banking APIs. On the other hand, FinTech companies can get an opportunity to access data for customer-centric solutions.

Banks would be able to strengthen their relationships with customers. It would be interesting to witness how traditional banks embrace this phenomenal change in the sector and its long-term effects.

Jignen Pandya

Jignen Pandya