Personal Finance Management App Development: A Comprehensive Guide

Developing a feature-rich personal finance app can be a monetary-beneficial idea for you.

It has become a problematic thing for people to manage their personal finances including bills, receipts, income sources, spending, overhead costs, policies, fixed deposits, and other financial things.

If there is an app that can manage all their personal finances in one place, people would welcome it. You can have all your financial records, investment portfolios, and other types of spending in one place. You can also have paperless personal finance management with such an app.

With such an app, people can manage their finances in a more mature manner. Hence, personal finance app development can be a good idea.

Though there are many such applications available already in the market including Mint, if you have any special features or benefits to offer to your audience, you can have a great chunk of market share in just no time.

However, the only condition is that your personal finance app must be easy to navigate, easy to use, and highly functional.

Technology has made our lives easier and highly comfortable. With smartphones, you can easily book a cab or order a meal while sitting at your home.

Before we delve into details, let’s check out some statistics on mobile applications:

Mobile applications are the new normal. These statistics simply reveal the same.

So you have decided to personal finance app development, but do you know about the nuances of developing an app? We will discuss everything you need to know about personal finance app development.

What is a Personal Finance App?

A personal finance app is a comprehensive app that manages all your assets, liabilities, utility bills, banking transactions, investment records, and other financial records. All these records are systematically stored in the app and can be monitored efficiently to track your financial activities.

Not just that, a personal finance app also helps you to better manage your money with taxation advice, investment tips, and other finance-related guidance.

Market Overview of Personal Finance App Development

Before you want to start anything, conducting in-depth market research is a welcome thing. It will give market insights, competitor analysis, and other useful information to check the feasibility of your idea.

When it comes to personal finance apps, there are various apps already in the market. Some of them are:

Mint: Mint is a personal finance app that allows users to track their financial activities for free.

You Need a Budget: It is another finance app that offers debt payoff and budgeting services.

Prism: The app allows users to pay bills online.

Spendee: Spendeee allows you to manage your shared expenses.

EveryDollar: The app has budgeting tools and it also tracks your expenses.

PocketGuard: The app has a user-friendly UI that helps in financial management.

Not just that, there are many banks that are entering the arena of personal financial activities with good apps.

One thing is clear: there is competition in this segment. However, if you have some unique features to offer to your audience, you can cut the competition and make your own audience.

What is The Role of a Personal Finance App?

The main aim of developing a personal finance app should be to help people manage their financial activities. The app must have features that can make people's lives easier by allowing them to manage their finances effortlessly and efficiently.

Some of the functions of the app should be:

- The app should allow users to track their bills and other utilities.

- The app should allow users to calculate their expenditures and income.

- The app should help people to plan their budgets efficiently.

- The app should help users systematically organize their finance.

- The app must be able to generate insightful reports.

You can build two types of personal finance management apps.

- A simple app with basic features

- A complex app with advanced features

A simple app allows users to input data manually. It does not have any risk factors as the app does not ask you to sync your bank account details to it. Also, the app development cost is less expensive compared to a complex app.

On the other hand, a complex app allows users to link their card details to the app. It has many advanced features for users to perform advanced functions. Also, the app allows real-time updates to users to manage their financial activities more efficiently.

Now, we will go through the steps to build a personal finance app that can offer some unique features to your audience and get more downloads for you.

Personal Finance App Development: How to Build It?

Here is a list of steps you need to follow to build a personal finance app.

1. Define Your Target Audience

The first thing to keep in mind is to define your target audience. Define them in terms of age, location, gender, and other parameters. For example, you can hit the segment of homemakers who find it difficult to manage their household expenditures. A user-friendly app can help them manage their expenses, bills, and other utilities.

Once you have defined your target audience, list down the issues they are facing. It is important that you have the right solutions for their pain points. Make a strategy of how to address those challenges by adding features to support them.

2. Conduct Competitor Research

Identifying your competitors and what they are doing is very vital. You will be able to get many insights for your app development.

Check out your competitors’ apps and the features and functionalities they are providing. Check out their monetization purposes and you will be able to learn many things.

The main vital thing is to check out services they don’t offer to their audience. Finding their service gap will help you determine the features you want to add to your app.

3. Define Your Purpose for Developing an App

What is your purpose to build a personal finance app? This is the answer to your question- how to build a personal finance app.

If you have defined your purpose, you will have the whole roadmap of app development. Also, in this stage, you need to determine the type of information you will need from users and the features you want to add to your app.

4. Don’t Underestimate Security

When you are asking for personal sensitive financial data from your customers, it is important that your app is highly secure and comply with all the security measures designed by the authorities. Security is the most critical aspect of your personal finance app and making blunders is not at all acceptable.

Compliance authorities such as GDPR and other authorities have special considerations when it comes to data security. You need to cater to these guidelines or you might face heavy penalties and other consequences, not to forget brand reputation.

Some of the security measures that you can take into consideration are

- Two-Factor Authentication asks for two forms of authentication from users to safeguard the data.

- Also, as you must have seen in banking apps, cut down the session mode.

- Don’t use catchy colors and fonts to display the personal financial data of the users on the screen.

- Follow the guidelines of data security authorities such as PCI DSS (Payment Card Industry Data Security Standard) and GDPR (General Data Protection Regulation).

- Apply data encryption techniques if you have added the chatting option to the app.

5. Define Your App Features

Now, it is time to list down all the features that you want to incorporate into the app. Shortlist all the features that a personal finance app must have in the app.

For example, some of the features that you can add are user registration, profile, income and expense tracking, notifications, bank account linking, calculations, reports, investment guide, social media sharing, report uploading facility, etc.

6. Select a Tech Stack

Now that you have shortlisted all the features, it is time to select the right technology stack for your app. Choosing the right tech stack is a vital component of the app development process.

This tech stack includes databases, libraries, frameworks, programming languages, front-end and back-end technologies, etc.

The front-end development is all about how your users will interact with the app. Here, you need to have an intuitive and impressive UI to attract your audience.

Choose the front-end technology wisely to have the best UI for the app. HTML, CSS, and JavaScript are some of the technologies that you can use for front-end development.

On the other hand, backend technologies are all about data loading, security, and ease of transactions. You can choose programming languages such as Ruby, Python, C#, and C++ for backend development.

7. Designing the Best UI/UX Design

A user interface will make a huge impact on people’s minds and their reactions to your app. You need to invest a significant amount of time and money to design the most innovative and intuitive user interface for your app.

It should be simple, uncluttered, and yet highly effective and attractive. Then only you can achieve the best user experience. Hire the best designers for the job and let them leverage their expertise to offer you the best UI/UX options.

8. App Development and Testing

This is the step where the actual development of the app takes place. Hire expert mobile app developers with prior experience in the domain.

Ask developers to first start developing basic features and then the advanced ones. Follow an agile app development approach to ensure that the app can be developed as per the deadline.

Then comes the testing and debugging. Mostly, developers and quality analysts work hand-in-hand to keep identifying bugs and errors and addressing them throughout the development process.

However, before you launch the app, ensure that there are no bugs and errors and that all the features are performing fine.

9. Application Launching

After fixing all the functional issues, it is time to launch the app. First, it would be wise to release the app to a small group of users to gain their feedback. You can make some improvements to the app as per feedback and inputs received.

10. Maintenance and Updation

This is the last stage of the app development process. Even after deployment, you need to ensure that the app is monitored by the developers and updated from time to time.

You can never know what issues arise due to any reasons, at such times, you need to respond quickly to fix the issues and offer a wholesome experience to your users.

Read more: How to Build a Future-Ready Fintech Application?

Cost of Developing a Personal Finance App

Well, when it comes to app development costs, there are no fixed answers to that. It depends on multiple factors such as the scope and size of the app, features you want to add to the app, location of the developers, and many other things.

On average, it will cost you from $40,000 to $60,000 to develop a personal finance app. If you want to add third-party APIs to improve features, the cost might go up.

Advanced Features to Add to the Personal Finance App

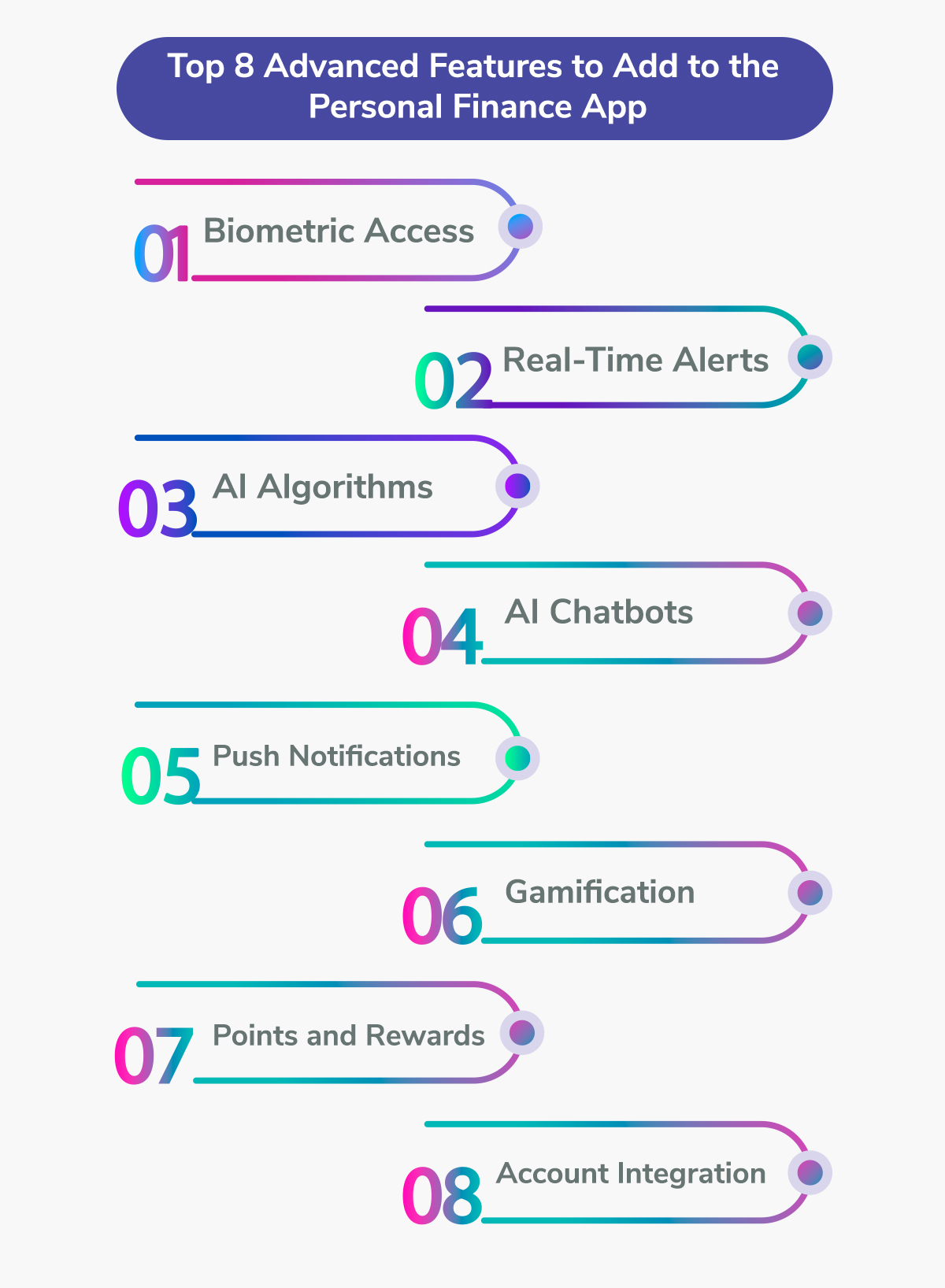

Here is a list of advanced features you should add to your personal finance app to offer more convenience to your audience.

1. Biometric Access

Biometric access is an authentication technique that allows the app to authenticate the user. It uses the unique qualities of a person for authentication such as voice patterns or fingerprints.

It has been common nowadays to add this feature to the app to strengthen security.

2. Real-Time Alerts

This feature offers real-time updates to the users to gain their confidence. Keep sending notifications related to real-time news or other information to ensure that users stay updated with the latest developments.

3. AI Algorithms

Artificial Intelligence is a technology that helps businesses to get data insights to offer a more customized experience to users. AI algorithms can help you offer a more personalized experience to your app users.

For example, the app can notify the users when they are spending too much amount on a particular category such as entertainment or grocery. You can also facilitate users with graphs displaying expenditures for categories.

4. AI Chatbots

This is for users who are confused while using the app or looking for specific information. Also, AI chatbots can also analyze customer data and behavioral patterns and can offer customized suggestions, recommendations, or tips. It helps to manage their money efficiently.

5. Push Notifications

With push notifications, you can update your customers with news, offers, recommendations, and other information.

For example, if you are giving some discount on your annual subscription, you can notify them with push notifications. You can also remind them about the bill dates and other information.

6. Gamification

If you want to engage your users, adding the gamification feature can help. Customers can have the best time while using the app and spend more time on it.

7. Points and Rewards

People love it when they are facilitated with rewards.

You can offer your audience some rewards in terms of discounts, coupons, points, and cashback. It will help you to keep your users more active on the app.

8. Account Integration

Users should be able to integrate all the financial information into the app including credit cards, debit cards, loans, mutual funds, fixed deposits, and others. They should be able to track all data from one app.

Conclusion

We have already answered the question: how to build a personal finance app. Here, we have covered all the details including the step-by-step guide, features, cost, and other crucial things.

A personal finance app can be monetized easily and you can offer a one-stop solution to users to manage their finances efficiently.

Hire a mobile app development company offering services in this domain and let them develop a comprehensive, feature-rich, and functional personal finance app for you.

Expert App Devs is a mobile app development company that offers the best resources for businesses and enterprises for hire.

Whether you are looking for a dedicated developer or a dedicated team of designers, quality analysts, and developers, they can offer the best talents at the best price in the market. Hire professionals for your app development project now.

Jignen Pandya

Jignen Pandya